payday loans of america Octubre 23, 2024

Virtual assistant IRRRL | Guidance, Requirements & Pricing 2024

What is the Va IRRRL?

The newest Va IRRRL, called the brand new Va Rate of interest Reduction Refinance mortgage, has the benefit of an easy service to have veterans trying to re-finance their latest Va financing on more advantageous words.

On Va IRRRL, short term loans Lexington Alabama there is certainly quicker records (no credit, earnings, or employment verification) and you will probably not require an appraisal. Closing costs as well as include lower and certainly will become folded to your loan to get rid of initial costs.

Va IRRRL Streamline Re-finance guidelines

Whenever looking for an effective Virtual assistant IRRRL, specific advice help be certain that a soft and you can profitable refinancing techniques. Whilst not necessary, this type of Va IRRRL guidelines are commonly with loan providers:

- Credit score: A credit rating away from 620 or higher is normally recommended to improve your likelihood of acceptance.

- Loan-to-Well worth (LTV) Ratio: Maintaining a good LTV ratio is recommended, particularly when you plan to roll settlement costs on loan.

- Fee Records: Uniform commission history in your existing Virtual assistant mortgage try recommended, as it shows financial balance, though money verification isn’t called for.

Understand that this type of Virtual assistant IRRRL recommendations bring recommended methods that lenders typically pursue so you’re able to improve the procedure, while standards (secured within the next point) are definitely the compulsory issues that have to be met so you can be eligible for a keen IRRRL.

Virtual assistant IRRRL Improve Re-finance requirements

To meet Va IRRRL criteria and you may qualify for an excellent Virtual assistant Streamline Refinance (IRRRL), your existing mortgage should be a beneficial Va home loan. People also needs to meet underwriting requirements set from the Company away from Experts facts.

- Present Virtual assistant Mortgage: The brand new debtor need currently have good Virtual assistant-recognized home loan.

- Occupancy: The house are refinanced ought to be the borrower’s first residence.

- Prompt Home loan repayments: The latest borrower need good percentage record on the current Virtual assistant mortgage, no one or more later commission in past times a dozen weeks.

- Internet Real Work for: The fresh re-finance have to result in a real benefit to the new debtor, particularly a diminished rate of interest, lower payment, otherwise a move from a variable-speed home loan so you’re able to a fixed-rates home loan.

- Resource Commission: More often than not, a financing commission is needed, nevertheless are going to be as part of the amount borrowed.

- No cash-Out: IRRRL is made for speed and you can term refinancing only; it does not support dollars-away refinancing.

- Zero Appraisal or Credit Underwriting: Occasionally, an appraisal or borrowing from the bank underwriting lined.

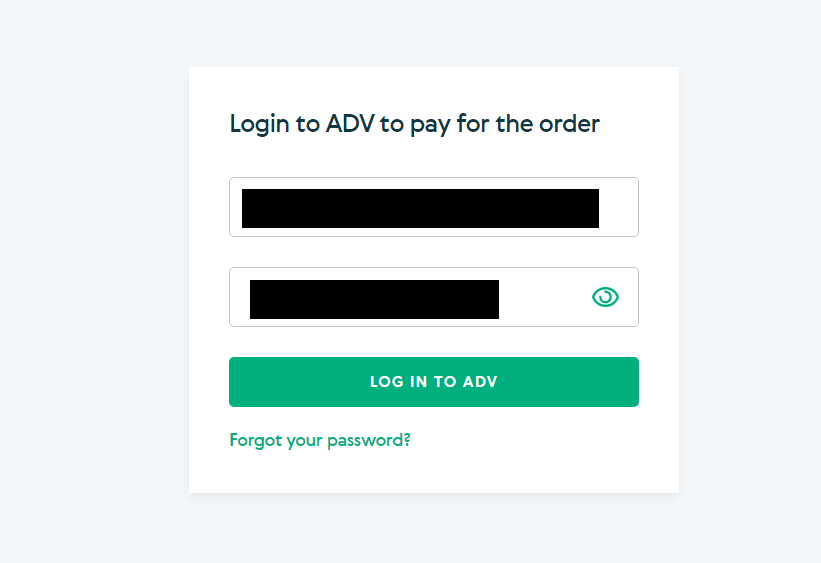

It is possible to figure out if you meet up with the Virtual assistant IRRRL requirements by the examining together with your current mortgage lender, and other bank that’s subscribed to accomplish Virtual assistant funds (some are).

Va IRRRL prices now

Virtual assistant IRRRL cost are some of the most readily useful financial pricing toward the market industry. Compliment of support on Company off Pros Affairs, lenders could possibly offer excessively low interest rates during these money.

Va IRRRL rates now,

The present starting rates to have a thirty-season Virtual assistant IRRRL is % ( % APR), according to our lender community*, showing some of the best Va IRRRL prices today.

Definitely, Virtual assistant re-finance prices are different from the buyers. The price should be higher otherwise below average established on the loan proportions, credit score, loan-to-value proportion, or any other items.

*Interest levels and you may yearly percentage prices for shot objectives just. Average cost imagine 0% down and a good 740 credit history. Come across all of our full mortgage Va price assumptions right here.

How the Virtual assistant IRRRL Improve Re-finance functions

Like most financial re-finance, the brand new Va IRRRL system substitute your existing mortgage with a brand new mortgage. The new loan starts new in the 30 otherwise 15 years, based and this mortgage title you select.

As the there is absolutely no money, work, or credit confirmation expected, individuals have less paperwork to deal with. And you also don’t need an alternate Certificate regarding Eligibility (COE), while the IRRRL can only just be used towards an existing Virtual assistant mortgage. So that the bank currently understands you will be Va-eligible.

LEAVE A COMMENT