payday loans for extremely bad credit Octubre 23, 2024

The length of time does it sample rating pre accepted to own a beneficial mortgage

T The house loan recognition process is an important part of to purchase a house, nonetheless it could feel like an intimidating and pulled-out experience. Knowing the schedule therefore the measures inside it might help lessen particular of your stress and set sensible criterion.

The home loan approval process fundamentally concerns multiple key levels: pre-acceptance, loan application, handling, underwriting, and you may https://paydayloancolorado.net/orchard-mesa/ closing. Per stage possesses its own band of criteria and you can timeframes, causing all round duration of the process.

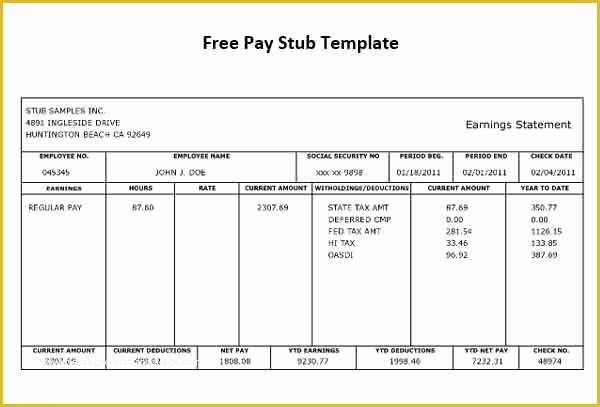

Pre-acceptance is the starting point yourself mortgage processes. It involves entry initial guidance so you can a lender to determine how far you could potentially use. So it usually need delivering economic documents, eg pay stubs, lender statements, and you can tax statements. The financial institution usually opinion your credit rating, earnings, and you can costs to assess your credit capability.

This full publication have a tendency to take you step-by-step through the newest grade of your own mortgage approval processes, normal timelines, factors which can influence the stage, and you will suggestions to expedite the procedure

Pre-recognition needs between several hours for some days, depending on the bank and exactly how rapidly you can deliver the required documentation. On line loan providers or mortgage brokers can frequently expedite this step.

Once you have found a home and had your promote approved, you are able to complete an official loan application. This involves completing a detailed means with information concerning your cash, work, plus the property you’re to purchase. You will have to render help files, eg:

Proof of income (shell out stubs, tax returns, an such like.) Proof property (bank statements, later years levels, etcetera.) Facts about the money you owe (mastercard statements, mortgage comments, an such like.) Private personality (driver’s license, social defense matter, etc.)

In processing stage, the lender product reviews your application and you may documents to confirm the guidance provided. This involves checking your credit report, verifying your own a career, and you may verifying the possessions. The lender may also buy an assessment of the property to dictate the market price.

Mortgage running will take step 1-14 days. Yet not, this will are very different in accordance with the difficulty of your own app and you may how quickly third parties, just like your company or even the appraiser, respond.

Underwriting is considered the most vital and thorough phase of the property loan acceptance techniques. The brand new underwriter analyzes the risk of credit for you from the looking at all aspects of your own financial situation, the house or property, plus the loan words. It be sure to meet with the lender’s requirements and you may assistance to possess the mortgage.

Underwriting may take from around a few days to a few months. Simple, easy programs could be underwritten rapidly, when you’re harder times or the individuals requiring info can take offered.

While the underwriter approves your loan, you proceed to the fresh closing phase. This calls for signing the past mortgage documents, purchasing closing costs, and you will commercially transferring ownership of the property. Possible remark and you may indication an ending Revelation, and that lines most of the terminology and you can will set you back of your own mortgage.

The fresh new closure procedure typically takes step one-2 weeks. This may involve enough time needed seriously to agenda the brand new closing fulfilling, get ready the mandatory files, and make certain all of the functions are ready to accomplish the transaction.

Several factors is influence the overall schedule of the house loan acceptance techniques, ultimately causing it to be reduced otherwise longer than mediocre.

The mortgage software itself can be finished in a day, but meeting and you will submitting all called for documents takes a great month so you can each week, dependent on your preparedness

Various other lenders has differing amounts of show and you may resources. Some loan providers layered process and you can advanced technology you to definitely facilitate the new recognition techniques, and others may take expanded on account of less efficient solutions or higher quantities regarding programs.

Your own readiness can also be rather change the schedule. With all the necessary paperwork prepared and able to fill in normally speed within the techniques. However, waits for the taking information or incomplete apps can be sluggish some thing off.

The type and you can condition of the home you might be to find can also change the schedule. Novel characteristics, such as those having non-simple provides otherwise people demanding extreme fixes, might require more appraisal or check time.

The general industry requirements is influence the fresh schedule. During level family-to get 12 months otherwise times of high demand getting mortgages, loan providers may go through backlogs, ultimately causing lengthened processing moments.

The newest wedding of third parties, such appraisers, name businesses, and you can house inspectors, can also be establish variability towards schedule. Waits out-of these functions is also stretch the entire recognition procedure.

However some circumstances is outside of the handle, there are lots of actions you can take to greatly help expedite the fresh home loan recognition process:

Delivering pre-recognized earlier house bing search can help to save date afterwards. Additionally, it reveals suppliers that you will be a significant client, which could make their bring more desirable.

Remain all the requisite data prepared and you will readily obtainable. This includes spend stubs, financial statements, tax returns, and any other economic details. Function on time to your demands from the lender for additional information.

Research and select a loan provider recognized for their overall performance and you may good customer service. Online analysis and you may recommendations from family otherwise realtors can be support you in finding a reliable lender.

Manage regular correspondence with your financial and operate easily to any demands otherwise concerns. Quick communication can help prevent waits and continue maintaining the method swinging effortlessly.

Sit proactive throughout the techniques. Followup on the position of the app continuously, and make certain that most 3rd-cluster actions, such appraisals and inspections, try arranged and complete punctually.

Facts common delays at home mortgage recognition procedure as well as how to get rid of them will help keep app focused.

One of the most popular delays try incomplete otherwise destroyed documentation. Double-look at your software and ensure all necessary data files are included and you will up-to-day.

Borrowing activities, particularly problems on your credit report or unresolved costs, may cause waits. Look at the credit report in advance and you can address one issues to ensure an easier procedure.

Delays when you look at the scheduling otherwise finishing the house or property assessment can decelerate this new acceptance techniques. Work on your own financial to help you plan the fresh new assessment when it is possible to and you may follow up to make certain its accomplished timely.

Waits in guaranteeing the a job also can change the schedule. Tell your company that they can receive a confirmation request and you can ask them to behave punctually.

The house loan recognition process concerns multiple values, per with its individual schedule and requirements. Because techniques usually takes 30 in order to forty five days out of initiate to get rid of, some situations normally dictate this schedule. Because of the knowing the degree, becoming prepared, and proactively controlling the procedure, you could help ensure a smoother and effective home loan recognition sense.

Applying for a mortgage are going to be an elaborate and you may time-drinking procedure, but with suitable education and planning, you can navigate it effortlessly. Remember to remain prepared, promote effortlessly, and select an established financial to manufacture your perfect out-of homeownership possible.

LEAVE A COMMENT