Forex Trading Abril 04, 2022

Morningstar Candlestick

Contents

In other words, the bears are fully in control the first day. The second day is an indecision day because the bulls and bears battled and now one took control. Confirmation is very important because, if there is no downtrend, there’s no point in trading the Morning Star pattern. You can confirm the downtrend on a higher timeframe or on your trading timeframe. As you can see in the below image, the overall trend of the CAD/CHF Forex pair was down.

Hi friends , today i’ll share with you the most famous candlestick pattern everyone should know. The evening star pattern occurs when there is a bearish reversal from a significant resistance level. This pattern indicates that buyers have failed, and sellers are now in control of the market. From an evening star pattern, traders should look for opportunities to short the market. This blog post will look at the morning star pattern and what it could mean for forex traders.

What is the difference between Morning Star and Evening Star candlestick patterns?

The drawback is that traders could enter at a much worse level as in fast-moving markets. The morning star is a bullish candlestick pattern and evolves over a three day period. It is a downtrend reversal pattern formed by combining 3 consecutive candlesticks. These is a visual pattern as there are no particular calculations to perform. There is a technical indicator that helps to predict if a morning star is forming. They are a 3 candlestick pattern that takes place near support levels.

The trader interprets this pattern and gets alerted to an imminent upward reversal of the stock price. An evening star pattern is a bearish 3-bar reversal candlestick patternIt starts with a tall green candle, then a… In the right market condition, the pattern can give a strong signal for taking long positions or closing short positions. When combined with other tools, such as trendlines and support levels, the pattern can be used to formulate a trading strategy. When trading in stock markets, these signals might also be influenced by the volume levels that accompany the event. In most cases, a stock trader waits to see rising volume as another way of confirming the potential for a true reversal in the market.

If you are looking for some inspiration, please feel free to browse my best https://bigbostrade.com/ brokers. I have spent many years testing and reviewing forex brokers. IC Markets are my top choice as I find they have tight spreads, low commission fees, quick execution speeds and excellent customer support. The momentum oscillators can give you the precise direction of the market, whether the Morning Star is providing the right signals. Morning Star Doji Candlestick PatternThe bearish version of the Morning Star Candlestick Pattern is the Evening Star Candlestick Pattern. It has a similar structure to the Morning Star and appears in an uptrend.

Bullish Morning Star At Key Support

Traders are looking to short more because there’s no price reversal signal on the horizon. This is the first candle of the Morning Star Candlestick Pattern. In this article, we’re going to have a closer look at the morning star candlestick pattern. We’re going to look at its meaning, how to improve the profitability of the pattern, and also have a look at a few example trading strategies. You can combine the Morning Star pattern with other technical analysis tools and indicators.

A morning star pattern is a variation of the bullish engulfing pattern. But the second candlestick in this three-candle formation must be a low range candle, such as a spinning top or Doji. Then follows a small real-bodied second candle that is either a Doji or slightly bearish, and then a third candle that has a real body and pulls close to the past.

The second https://forex-world.net/ is a candle with a small real body, also known as a doji. We should be entering the trade when the next green candle closes. We can close the position at any resistance area or supply-demand zone. In this trade, we hold our positions because we took the trade from the beginning of a new trend. You can also close your positions when the price goes near the higher timeframe’s significant resistance level. As you can see in the below CAD/CHF chart, the market prints the Morning Star pattern by following all the rules of our strategy.

- In fact, you should use other tools to confirm the pattern anytime you are trading it.

- Clarification only comes on the third day of the morning star doji candlestick pattern when prices rise over half-way into the price area of the first day’s bearish candlestick real body.

- So it is a good idea to place the stop loss just below the second candle.

Limit using Morning Star pattern when the market goes sideways. Because the accuracy of this candlestick pattern is not high in a sideways market. Pairing this pattern with volume makes it more reliable to trade. So it is a good idea to place the stop loss just below the second candle.

Price action traders use it as a signal to spot a buying opportunity in the market. Looking at the chart, once the formation has completed, traders can look to enter at the open of the very next candle. More conservative traders could delay their entry and wait to see if price action moves higher. However, the drawback of this is that the trader could enter at a much worse level, especially in fast moving markets.

What Does a Morning Star Tell You?

Many traders also use price oscillators such as the MACD and RSIor volume to confirm the reversal. The second line may be any white or black candle appearing as a short line, except the doji candles. The body of the candle needs to be placed below the prior body, that is the opening and closing price needs to be lower than those of the previous candle.

Find the approximate amount of currency units to buy or sell so you can https://forexarticles.net/ your maximum risk per position. Learn how to trade forex in a fun and easy-to-understand format. Then the bears are trying to gain control but without success. By using one or more of these sites, you can quickly and easily find stocks that may be about to make a move higher. In addition, all four of these websites offer users the ability to create custom screens and save them for future use.

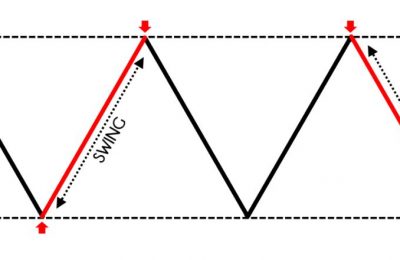

In other words there needs to be a gap between the first and the second body. If you are new to candlesticks, read our guide to the top 10 candlestick patterns to trade the markets. Traders will often look for signs of indecision in the market where selling pressure subsides and leaves the market somewhat flat. This is where Doji candles can be observed as the market opens and closes at the same level or very close to the same level. This indecision paves the way for a bullish move as bulls see value at this level and prevent further selling. The appearance of the bullish candle after the Doji provides this bullish confirmation.

Heiken Ashi Charts: Identify Trends with Reduced Market Noise

But in the real live market scenario, the market moves on its own. The appearance and position of the Morning Star and the Evening Star are just the opposite of each other. In the subsequent periods, the candles are green and show higher highs. In this strategy, we’ll use RSI to define when the market has fallen enough.

For these reasons, aggressive traders might begin thinking about establishing new long positions in anticipation of an upside reversal. Of course, trading based on Morning Star patterns alone might not be the best way of achieving a comprehensive trading strategy. This is why expert traders will often combine these signals with technical indicators and market value readings before entering into live positions in the market.

Once the reversal takes place, it will be easy for a trader to observe a higher high and a higher low. However, the trader needs to take into account volume and the fundamentals before solely trusting the technical. The morning star shows the slowing down of a downward move and indicates that an uptrend is about to follow. Morning Star Candlestick Pattern is one of the most used technical analysis tool by technical analyst. We introduce people to the world of trading currencies, both fiat and crypto, through our non-drowsy educational content and tools.

LEAVE A COMMENT