new cash advance loans Octubre 10, 2024

HELOC: What is actually a property Security Personal line of credit?

If you’ve got a massive bills approaching but don’t a bit have sufficient offers to fund they, you think a house security personal line of credit (or HELOC) can help you pull with her the bucks to do the job.

But what exactly was property guarantee personal line of credit? How come it works? Which is it simply a money option for things such as a house renovate, later years life style or educational costs? New answer’s no! Good HELOC may seem such a good idea, however it is in fact one of the greatest economic barriers you might fall into.

What is a home Equity Credit line?

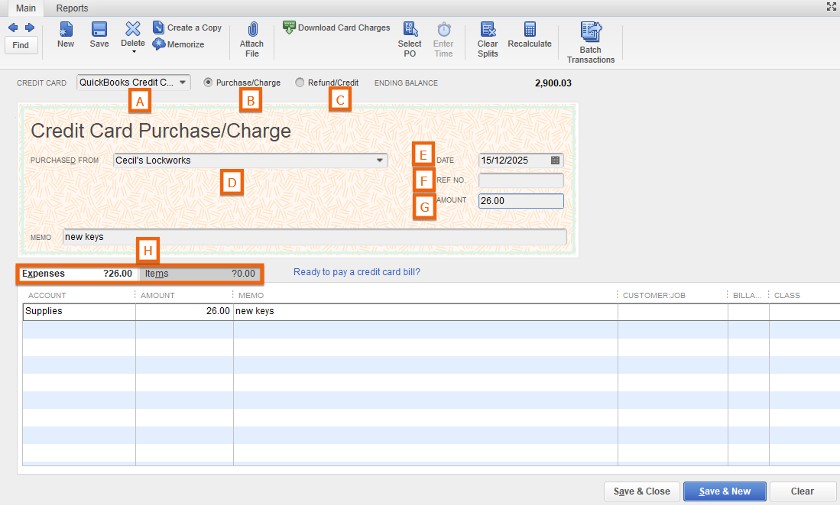

Property security personal line of credit, otherwise HELOC, is a type of house guarantee mortgage which enables you to definitely borrow funds resistant to the most recent value of your residence. It can be used for all types of requests as much as an approved number, it functions similar to a charge card.

Plus instance credit cards, a HELOC uses good revolving personal line of credit, and therefore since you repay everything borrowed, extent you paid back gets for you personally to expend again.

Having HELOCs, it’s easy to get caught for the reason that rotating doorway of borrowing and you will all of a sudden wind up into the a rigorous (even crucial) financial location-particularly if you happen to be carrying a leading equilibrium.

HELOC versus. House Equity Loan: What’s the Differences?

A HELOC is pretty similar to property guarantee loan. Area of the variation would be the fact a home guarantee loan enables you, the latest borrower, when planning on taking a complete lump sum you’ve been acknowledged for everyone immediately in the place of utilize the fees-as-you-go type of good HELOC.

Domestic equity financing are very likely to provides a bad credit personal loans Indiana fixed rate of interest, which means that your monthly obligations become more predictable than simply they’d be that have a good HELOC, which have variable rates of interest.

How come a home Equity Personal line of credit Works?

How a great HELOC works is different from a typical mastercard otherwise financing whilst spends your residence guarantee since equity.

Your residence collateral ‘s the percentage of your home you very own downright (aka the difference between how much cash your home is well worth and you will how much cash your debt in your financial). And you may collateral is the coverage for the loan-to put it differently, this is the matter your vow to offer to the bank when the you simply cannot repay your debts.

Don’t skip you to definitely: Good HELOC spends the element of your residence that you very own just like the guarantee. That means if you fail to pay back the fresh HELOC, the lender can be foreclose on the domestic. Yikes!

Now you can see why do not highly recommend HELOCs-because if you have made one of those creatures, you’re risking the latest rooftop more your mind!

But just so you can find out how it really works, why don’t we imagine you have been accepted to possess good HELOC, plus personal line of credit is actually $40,one hundred thousand. You may spend $thirty-five,one hundred thousand upgrading your kitchen. (Hey all, subway tiles and you will shiplap.) Now you just have $5,100 leftover to use if you do not change what you to start with borrowed. When you spend one $thirty-five,100 back, you have $forty,100000 open to purchase again.

Exactly what do You employ a HELOC To possess?

- Home renovations

- Paying down almost every other obligations (like the mortgage, figuratively speaking, playing cards or scientific costs)

- Old-age bills

- Buying trips or investment qualities

- Taking extended periods of time regarding performs

- Emergencies

- Huge expenditures, such a wedding, educational costs or awesome like trips

Men and women are a couple of very significant things that may either be really exciting otherwise most frightening (otherwise both). So we rating as to the reasons its enticing to carry out an effective HELOC to try to buy them.

LEAVE A COMMENT