payday loan with bad credit and no credit check Octubre 07, 2024

HECM compared to HELOC Mortgage Testing: Which is Right for you?

Even though the will cost you to ascertain an effective HELOC (Family Security Credit line) with a HECM ( Family Security Sales Financial ) is highest and you also possess mortgage advanced (MIP) to the mortgage too you to definitely do add a supplementary .50% on accrual (the brand new MIP isnt interest but it accrues exactly the same way), the interest pricing to own a good HECM line of credit are very just like a property Guarantee Credit line you’d found of a bank.

I talked about the price setting it. The fresh HELOC from your own local bank create almost certainly getting quicker to set up making sure that is in their choose.

However, after that, the reverse mortgage line of credit has plenty going for they the HELOC does not.

HELOC money require monthly payments and you will recast once 10-ages

Brand new HELOC necessitates the debtor and then make repayments, usually of interest simply, within the mark period and then the loan enters an installment period.

HECM funds need no monthly premiums

The reverse mortgage needs no payment anytime however, plus sells zero prepayment punishment therefore one percentage doing and you may as well as percentage in full is generally produced anytime as opposed to penalty.

Consumers can make a payment on the amount of the interest which is accruing to store the balance out-of rising, they’re able to spend more than the attention that is accruing to help you reduce steadily the balance or capable will waiting and you can spend all of it of when they leave the home.

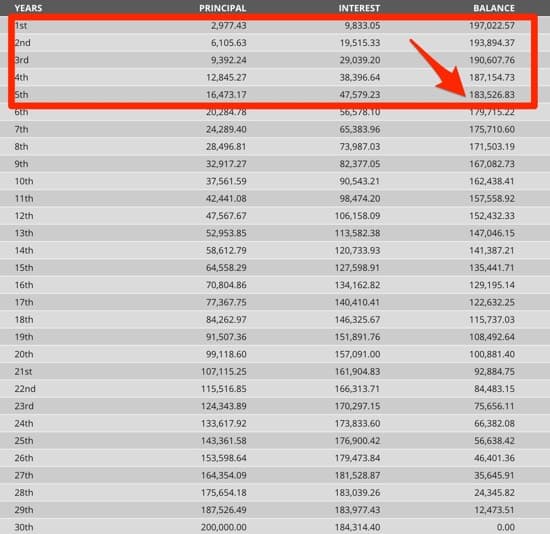

Borrowers is examine a keen amortization plan to possess a standard or submit loan to this out of a contrary mortgage and you may come across you to with the a frequent mortgage or into the a beneficial HELOC, additionally you spend a good amount of appeal historically and you may you then have the principal remaining to invest.

The real difference isn’t as great as you manage faith as into the give financing youre make payment on monthly payments and you will to your opposite home loan, for folks who repaid them too you’d keeps exactly as much remaining but when you choose shell out absolutely nothing, there is the spendable (otherwise savable) cash monthly that you’d n’t have if not got.

Obviously unless you you want people mortgage, might most certainly do have more equity leftover instead of a need in americash loans Mystic order to use.

HECM funds possess a different sort of personal line of credit increases function

As opposed to a beneficial HELOC, a great HECM expands throughout the years towards the unused harmony. This isn’t attention anybody is investing you, it is a boost in the amount available.

When you have your range for a long time and then have not tried it or every thing, the remaining balance available is growing providing you with even more entry to financing afterwards should you decide you would like him or her.

Plus in the place of a great HELOC the spot where the lender will cut or close the loan when with no warning, the opposite mortgage can not be signed or reduce for as long as you live in the house and you may abide by the latest terms of the mortgage (pay your fees and you may insurance on time).

If you are and come up with payments towards the an opposite financial and acquire that you never some times otherwise must prevent entirely, there are not any unfavorable implications to possess doing so.

The reverse home loan transform as the Trump management is the fact that costs are actually reduced adequate and so the the latest money being written provide debtor high mortgage wide variety today.

One of several issues one decides how much money good debtor will have ‘s the interest rate toward loan (along with the age of the youngest borrower toward financing, the house target therefore the HUD financing restriction ).

Given that pull-back of your Dominating Maximum Products, the business might have been significantly more responsive to help you jumbo otherwise proprietary software too.

We come across numerous this new applications appear within just for the past very long time enabling much more borrowers access to so much more personal software and you can on most readily useful cost.

Whenever contrasting an opposite mortgage, it’s important to speak to your members of the family and respected monetary coach to help you consider both pros and cons . Find out more about exactly how a great HECM mortgage would-be suitable for your by calling our most useful reverse mortgage lenders , or check your qualification with the 100 % free contrary mortgage calculator .

LEAVE A COMMENT