get a payday loan now bad credit Novembre 14, 2024

Less than perfect credit? You have got Several options for choosing a property

Everything you need to find out about mortgage brokers under one roof. Play with all of our “faqs” point to learn exactly about mortgages, refinancing, household collateral credit lines and.

Once you was indeed at school, it was scary to listen you to definitely anything might possibly be apply your long lasting list. But, because proved, you to was not such as for instance an issue. The actual only real long lasting number you must concern since an adult will be your credit reports. A rocky start otherwise a long hard spot helps make it very difficult to purchase property of. Once you couple one issue with with a little or nonexistent down-payment, there are not a good amount of choices for pick.

Additionally, your ong the fresh new fortunate partners who will nonetheless enter good system and no currency and you may troubled borrowing. So many no down apps have ended considering the real home , just a few of good use of those are out there.

There is no use in hyping your right up simply to get the expectations dashed in the future. Here commonly a great amount of applications that can undertake a bad credit score when it’s coupled with zero advance payment. The danger you to definitely financial institutions was basically confronted by during the credit crunch enjoys generated all of them a great deal more old-fashioned in terms of the version of consumers they might be willing to undertake. Its nothing against your personally, it is simply one some actuary someplace told you you had a certain percent danger of standard. Because it looks like, that commission is just too much for almost all banks, closing enough gates.

You will find, but not, a couple applications that can however accept you that have good reasonable credit rating. Let’s see if them was the right meets.

United states Agencies from Farming Solitary Family relations Casing Guaranteed Financing Program

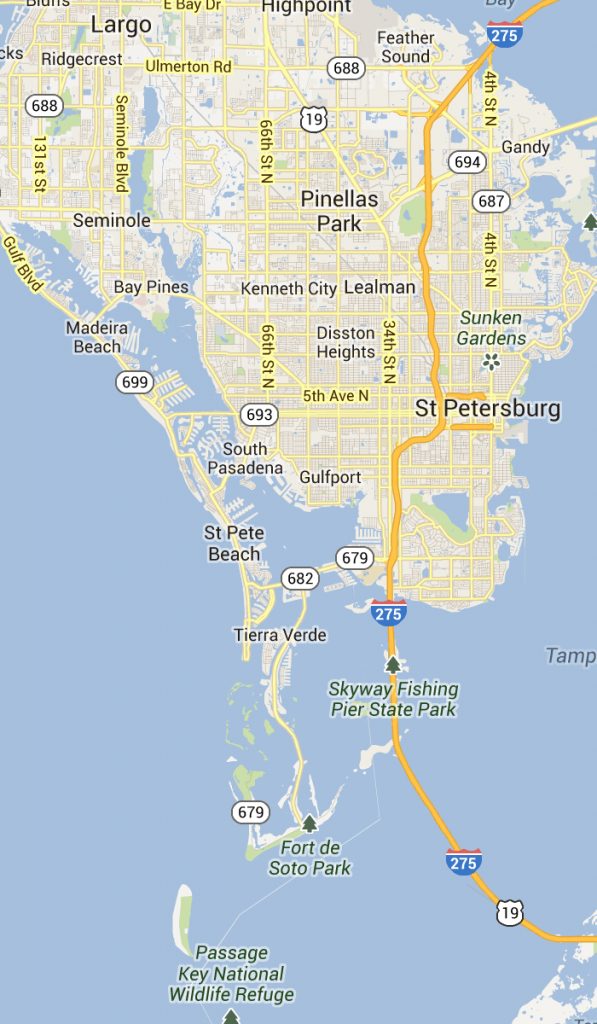

This choice try available to anybody who can meet the cash criteria and you may intentions to are now living in an area considered rural. It basically function a place which have around thirty-five,000 citizens. With this particular system, in addition there are assistance with settlement costs. USDA have a tendency to check your borrowing, but they are way more flexible of early in the day credit calamities than simply most other organizations.

USDA Solitary Members of the family Property Head Financial

Whether your earnings place you towards the reasonable- otherwise really low-income brackets once the determined by the latest USDA, you ily Housing Head Financing. There are numerous statutes regarding the particular household you to definitely you can purchase using this type of financing. The fresh new features tend to be:

It looks like a great amount of nitpicking, but if you get your advance payment and you will closing costs covered and you will spend an interest rate as little as 1 percent, its worthwhile. Plunge from the hoops; you might not regret it.

Virtual assistant Lenders

Productive and you will retired people in brand new army get qualify for good Virtual assistant mortgage, rescuing the trouble a part of a normal home loan. Virtual assistant loans generally need no advance payment and are generally very versatile whenever you are looking at fico scores. Simply because this new Va promises your loan into the financial that’s composing it, progressing some of the duty compared to that organization. It is really not the same as good co-signer, nevertheless when it comes to the bank financing the cash, it is going to would. Don’t think the Virtual assistant wouldn’t evict you for many who prevent and work out your payments, though. It will and it will continue doing therefore. The loan constraints consist of year to year, but the Virtual assistant are kind adequate to publish the individuals changes here.

Non-Certified Mortgages

These financing usually are described as B/C Papers, Non-Conforming Traditional Loans, or even simply Crappy Papers Financing of the mortgage positives. It will not bring an enormous intellectual dive to determine as to why. You happen to be capable of getting a home loan on one from these businesses, even with little down and you will less than perfect credit, however you can also regret it immediately.

B/C funds are built and when the worst regarding the exposure character and with the large interest levels you are americash loans Granby able to. They have a tendency to utilize a good amount of low-standard tools making a payment complement well inside your earnings. A loan provider can offer your an enthusiastic interest-only mortgage or a pay option Case, one another issues you’d be far better avoid.

In the event you decide on a b/C lender, examine their online profile very carefully, read all file all the way through before signing and you can, above all else, make sure you extremely know very well what you are getting. Variable price mortgages that adjust immediately and often will likely be a recipe for default; people appeal-just money and you can shell out solution Fingers possess a proven track record to have doing negative collateral. The last thing you want is through buying our home regarding the goals and you can dump it toward bank.

LEAVE A COMMENT