payday loans com Octubre 11, 2024

11 facts to consider before refinancing your own home loan

Refinancing your residence loan is one way from getting manage of personal debt to make savings otherwise grow wide range. But there are many what you want in order to think about just before you’re taking the fresh dive.

Doing this can help you to sometimes generate savings otherwise power your wealth gains. But like many one thing throughout the money community, refinancing can sting you if you aren’t cautious, so there are a few things you need to know prior to refinancing your residence mortgage.

2. Will set you back to help you refinance a mortgage

The numerous costs away from refinancing home financing can occasionally place you straight back thousands, leaving you thinking if it try worth every penny.

To quit people nasty shocks, glance at the fine print of both your current house loan plus the mortgage you are looking to loans Trinity refinance that have and determine just what change’ costs could be, as well as discharge fees, valuation charge, split will set you back, an such like.

If you are refinancing discover less interest, you really need to very first estimate simply how much quicker it is possible to spend when you look at the appeal at this price (this can be done having fun with our house loan money calculator) and you may compare that it rescuing into the total price out of refinancing. That ought to make you an idea of if the refinance is worthwhile.

You will probably find one to through the attention offers, you can generate back this new refinancing costs in this a-year. In case it is planning capture a several years to recuperate new price of switching, you may have to think other available choices.

step 3. Worth of & your security

Whether you’re refinancing so you can secure less interest rate or perhaps to free up some money from your home loan, you need to take into account the latest worth of your residence and you will simply how much equity you may have on it.

You should use loan-to-well worth proportion (LVR) as a measure of security. This really is conveyed while the a percentage. Very, when your house is well worth $700,000 therefore owe $350,000 in your home loan, the loan-to-well worth proportion is actually 50%.

While the possessions rates go up (as they commonly do-over the long run), the new collateral of your house may rise. You have started out that have a fundamental financing-to-really worth proportion out-of 80%, purchasing your property to own $five-hundred,000 which have a great $100,000 (20%) deposit and you can good $eight hundred,000 home loan

A boost in your residence value, including decreasing the number you borrowed on your own mortgage, will help the security you’ve got – in such a case out of 20% so you can 50%. Meanwhile, the loan-to-worthy of ratio features faster off 80% in order to fifty%.

When refinancing to find a less expensive interest, less LVR will generally sit your in the a stead. However, if you are searching in order to re-finance that have an LVR more than 80%, you can even not be able to be eligible for a low interest rates for the the market.

When you are trying re-finance which have another type of lender, you can even deal with paying to possess Lenders Financial Insurance (LMI) even though you already paid for it when you got out your new financing.

Whenever refinancing to view several of the guarantee (like, to cover a remodelling or perhaps to purchase it an additional property), you’ll be able to essentially have the ability to use around 80% of one’s property’s worth without having the an excellent loans.

So, in case the house is well worth $700,000, you would be in a position to acquire 80% of the, otherwise $560,000, less extent you owe in your mortgage, $350,000. That’s $210,000 when you look at the guarantee freed up out of your home mortgage which could go somehow having paying for renovations or some other assets.

Borrowing more than just who does force your loan-to-well worth ratio past 80% LVR and therefore of several lenders might not be comfortable with. However, lenders’ formula vary more. If you are looking so you can refinance, its smart to search around for a lender one best match your position and you will situations.

cuatro. Credit rating

Maybe you have searched your credit score recently? If it’s not great, you might find they functioning facing your time and effort in order to refinance.

And, refinancing is short for a software for borrowing, which also appears on the credit file and can determine your credit score.

Loan providers should be careful of those who refinance too frequently, so with numerous financial refinances on your credit history can affect your own interest bargaining strength or in reality your own eligibility to help you re-finance.

5. Newest financial interest rates

Its smart to be round the exactly what rates are performing into the our home financing market and you will what a variety of gurus try forecasting. In the event the interest levels are required to increase along side 2nd few ages, you may want to believe refinancing so you’re able to a fixed price family loan.

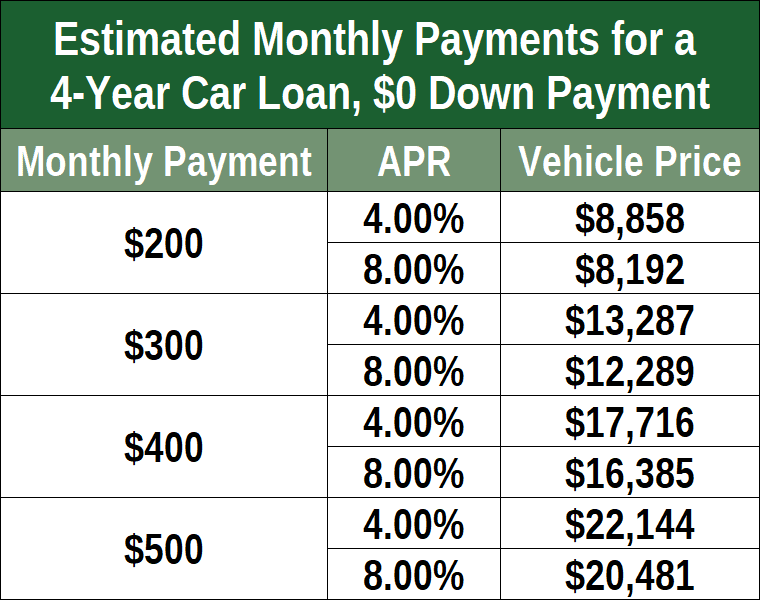

A large financial company provide certain general advice out of asked moves in the market, it is advantageous analysis own research prior to deciding so you can re-finance. New dining table lower than may also help you see a few of the lower rates of interest available today in the business:

LEAVE A COMMENT