Forex Trading Setembre 13, 2021

European Central Bank raises 3 key interest rates by 50 bps

Contents:

Elsewhere, the safe-haven Japanese yen remained in favour even as markets calmed a little. That stability also helped the Swiss franc to strengthen, and the dollar at one point fell more than 1% against the franc, to 0.9232, reversing some of its 2.15% surge on Wednesday – the largest daily gain since 2015. “And so because the Fed has such status, this creates a kind of doubt across the board on the quality of supervision and whether what we think we know about banks is actually right,” Veron said. I agree to the processing of my personal information for personalized recommendations, personalized advertisements and any kind of remarketing/retargeting on other third party websites. Articles outside the subscription period can be bought separately for a small price per article.

ECB raises eurozone interest rate despite banking sector fears – The Guardian

ECB raises eurozone interest rate despite banking sector fears.

Posted: Thu, 16 Mar 2023 07:00:00 GMT [source]

The rate on its weekly and daily cash auctions was also increased by 50 basis points to 0.50% and 0.75%, respectively, and a signal was given that additional hikes to its three rates were likely to occur this year. “The risk that they do 25 bps is not zero but it is low, as it would send a terrible signal to the market,” said Frederik Ducrozet, head of macroeconomic research at Pictet Wealth Management. “Rather, the ECB might communicate on the support measures and backstop facilities they could put in place in order to make sure that banks have sufficient access to liquidity at any time.”

Cryptocurrencies important part of discussion under India’s G20 presidency: Sitharaman

Moneymunch does not share in your profits and will not take responsibility for any losses you may incur. That was before Silicon Valley Bank in the U.S. went under last week after suffering losses on government-backed bonds that fell in value due to rising interest rates. The ECB also announced a new instrument, the Transmission Protection Instrument, in an effort to mitigate the effects of the increase in borrowing prices .

“We are determined to fight what is principal’s liability,” ECB president Christine Lagarde said at a press conference after the meeting. Its latest decision leaves the three main rates in the 20-nation currency club 3.5 percentage points higher than July. The ECB also noted the eurozone’s banks were “resilient, with strong capital and liquidity positions”, and Lagarde insisted the institution was poised to act if needed. “We are monitoring current market tensions closely and stand ready to respond as necessary to preserve price stability and financial stability in the euro area,” she said.

Credit Finance

But the Swiss National Bank threw Credit Suisse a $54 billion lifeline overnight, a big enough show of force to send its shares back up more than 20% and lift other bank stocks. Euro zone bank shares have been in freefall this week, spooked first by SVB’s collapse, then a plunge in the value of Credit Suisse, a lender that has long been dogged by problem. The yield on benchmark 10-year Treasury notes rose to 3.3821% compared with its U.S. close of 3.494% on Wednesday. The two-year yield, which rises with traders’ expectations of higher Fed fund rates, was up 8.2 basis points at 4.06%. They are also anticipating a combined 230 basis points of moves in the deposit rate by the end of 2023, putting the interest rate peak close to 2%. ECB hikes rate by 75 bps and what are the implications-Your browser does not support the audio element.

This was done to control borrowing costs for the euro zone’s most indebted nations. Market pricing now suggested a smaller, more cautious 25 bps move, was now anticipated. Inflation at 8.5% in February was well above the bank’s goal of 2%, and prices levels are taking their time to fall in response to ECB rate hikes after hitting a peak of 10.6% in October.

As expected, the ECB is holding the refinancing rate at 0.05%, the level introduced this time last year. 1) KYC is one time exercise while dealing in securities markets – once KYC is done through a SEBI registered intermediary (Broker, DP, Mutual Fund etc.), you need not undergo the same process again when you approach another intermediary. How far and how fast interest rate rises now impact real estate is not as straightforward to foresee. Transform with technology Implement tools, processes, and strategies that improve the value and performance of your real estate. Design & deliver projects Breathe life into old space, or create something brand new to help your people thrive.

In another change, the ECB also said that minimum reserves would be remunerated at the deposit rate, rather than the main rate, which is 50 basis point higher. Markets expect the deposit rate to hit 2% in December, then peak at around 3% sometime in 2023, although the excessively volatile outlook makes this timeline prone to changes. The analysis and discussion provided on Moneymunch is intended for educational and entertainment purposes only and should not be relied upon for trading decisions. Moneymunch is not an investment adviser and the information provided here should not be taken as professional investment advice. The commentary on Moneymunch reflects the opinions of contributing authors who are certified or otherwise. Before buying or selling any investments, securities, or precious metals, it is recommended that you conduct your own due diligence.

European Central Bank raises eurozone interest rate by 0.5%

Then, globally connected Swiss bank Credit Suisse saw its shares plunge this week and had to turn to the Swiss central bank for emergency credit. There is much debate also over whether the US central bank will continue with its rate tightening campaign as the collapse of SVB has been widely linked to the sharp rise in borrowing costs over the past year. This latest interest rate hike will push borrowing costs to reportedly the highest level since late 2008. Accordingly, the interest rate on the main refinancing operations and the interest rates on the marginal lending facility and the deposit facility will be increased to 3.50%, 3.75% and 3.00% respectively, with effect from 22 March 2023.

In 2023, it sees inflation at 3.5% and in 2024 at 2.1%, indicating four straight years of inflation overshoots. With less money to go around, price rises are slowing – and could even slip to deflation. That’s why the ECB could move to print more money, although most analysts expect Draghi will just try and “talk the euro down” by signalling he’s willing to take action.

Will Crude Oil Hit 5400 Next Weekend?

Even in the Euro Zone, despite an extremely tight labour market, unemployment stands at a record low of 6.6%. The ECB also must keep an eye on the euro’s sagging value against the U.S. dollar, although the ECB says it does not target any particular exchange rate. The euro rose above parity with the dollar on Wednesday but remains near its lowest level in 20 years. The ECB said that the increase in the policy rate by 0.5 per cent is justified given the inflationary risk.

This means that the interest rate in banks will now increase which was negative till now. In the quiet period that silences ECB policymakers before rate meetings, ex-officials Vitor Constancio and Lorenzo Bini Smaghi have weighed in to advise a quarter-point increase at most. Former Federal Reserve Vice Chair Alan Blinder is similarly minded, telling Bloomberg TV that he’d leave borrowing costs untouched this month due to the potential consequences for Europe were Credit Suisse to fail. With the Fed’s next rate meeting still a week away, the ECB will give the first indication of what the banking blowup means for monetary policy.

The rate has been negative since 2014 to encourage banks to lend rather than deposit money with the bank. Central banks around the world, including the Bank of England and America’s Federal Reserve, have been raising rates as price rises accelerate. Soaring energy, fuel and food costs are pushing up inflation, putting pressure on struggling families. The ECB began cutting interest rates after the 2008 financial crisis to stimulate growth and took them as low as minus 0.5 per cent during the pandemic. Higher rates can control inflation by making it more expensive to borrow, spend and invest, lowering demand for goods. But the concerted effort to raise rates has also raised concerns about their impact on economic growth and on markets for stocks and bonds.

Will ECB raise rates by 50 basis points today?

Declining https://1investing.in/ prices in recent months have helped slow inflation to 8.5 percent in February. Cover inflation, which excludes volatile energy and food prices, remains stubbornly high, however. Inflation is projected to remain too high for too long, the central bank said in a statement on Thursday. The decision reflected the bank’s determination to bring inflation down to its 2 per cent target.

- The European Central Bank hiked on Thursday its interest rate by 0.5%, in its latest review this year, as it tries to control rising inflation in the Eurozone.

- He predicted, however, that the ECB may “turn more dovish” in the coming weeks, “probably hinting at a slowdown in the pace and size of any further rate hikes”.

- The rate has been negative since 2014 to encourage banks to lend rather than deposit money with the bank.

- “Rather, the ECB might communicate on the support measures and backstop facilities they could put in place in order to make sure that banks have sufficient access to liquidity at any time.”

- The euro area banking sector is resilient, with strong capital and liquidity positions.

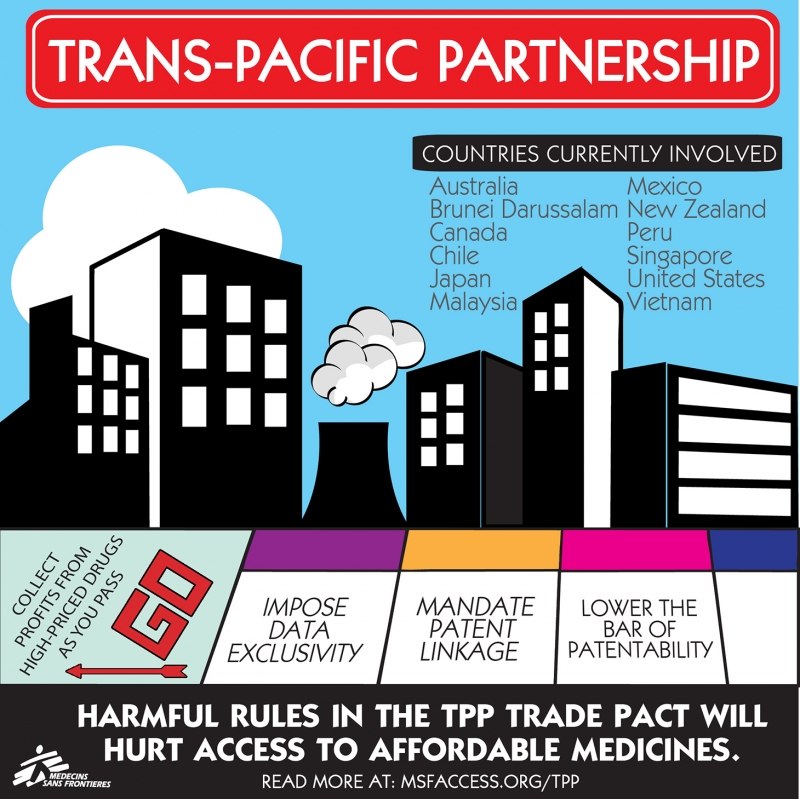

With their collective knowledge and expertise, they have a proven track record of successfully predicting market movements and identifying profitable opportunities. European banks also observe international rules that raised the amount of ready cash they had to keep on hand to cover deposits. This will enable it to purchase bonds when it detects indications of financial fragmentation, such as an unjustified gap in borrowing costs among the 19 member states of the eurozone.

They do not represent the views or opinions of newindianexpress.com or its staff, nor do they represent the views or opinions of The New Indian Express Group, or any entity of, or affiliated with, The New Indian Express Group. Newindianexpress.com reserves the right to take any or all comments down at any time. Like the ECB, it has decreased the pace of increases, following four consecutive 0.75% rises before Wednesday’s. On Wednesday, the Federal Reserve introduced a base interest rate to stand at between 4.25% and 4.5%. Sign up for a weekly brief collating many news items into one untangled thought delivered straight to your mailbox. For these reasons, the outlook for the second half of 2022 and beyond is looking hazy.

LEAVE A COMMENT